Even with big discounts as low as 50 cents on the dollar, Wall Street investors are selling off U.S. stakes. In preparation for a massive downturn in the U.S. economy, they hope to buy cheaper assets when the storm hits.

Private fund investors are letting go of these stakes at significant discounts because they expect the economy to worsen. They believe they can soon buy even more assets at even lower prices.

This trend has been happening quietly for a while, but now we are seeing larger trades take place. Investors are willing to sell at "up to 50% discounts," showing they are convinced the U.S. is heading into a recession.

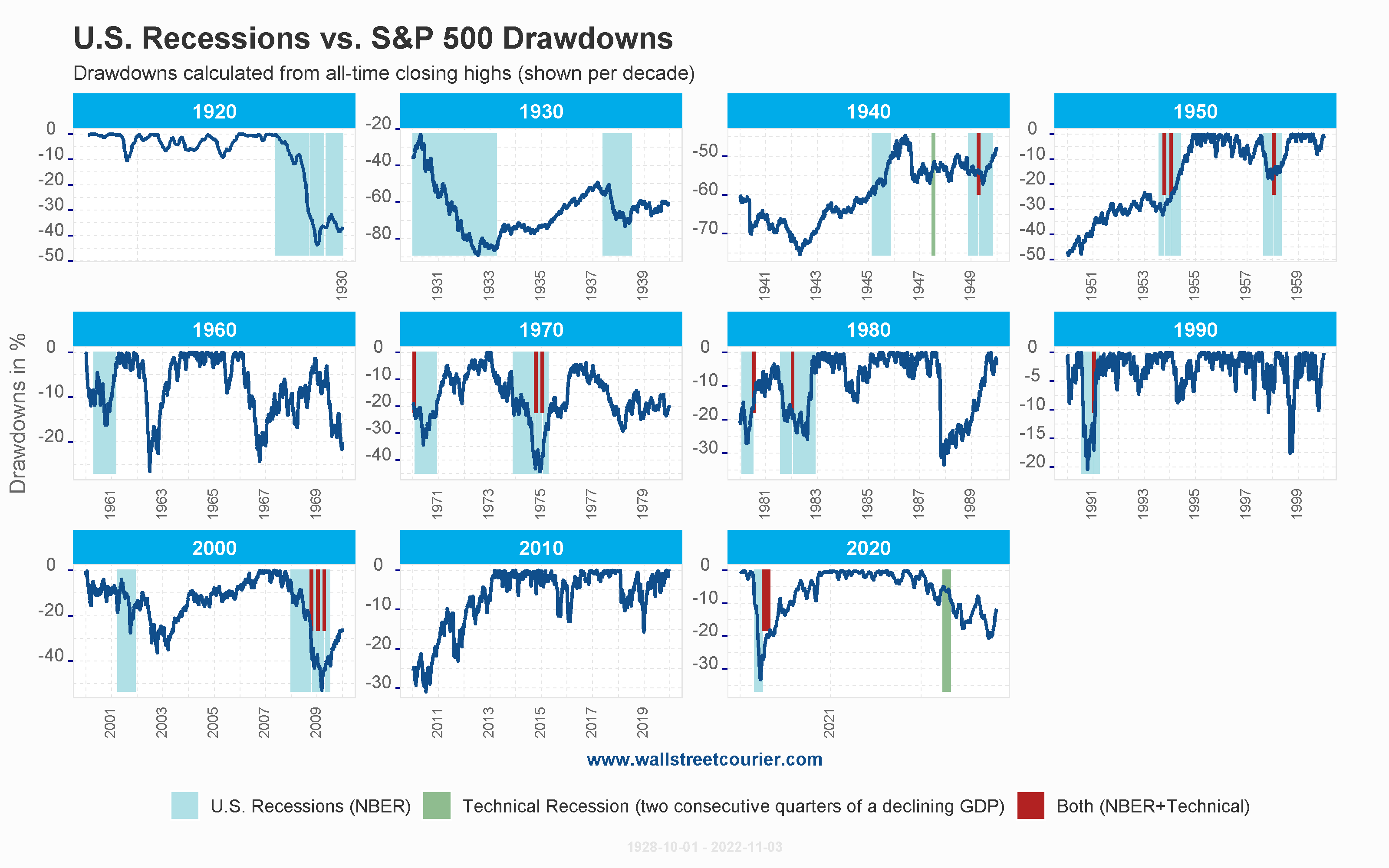

In Q1, the U.S. GDP dropped by 0.3%, largely due to the tariffs Trump imposed back in February. But as any football player will tell you, this is just the beginning. The real impact may show up in the Q2 results, which could be much worse. That’s why many investors are liquidating their holdings — they are preparing for the larger economic pain that is still to come.